Hi there!

Here's the latest feed from TechCrunch.

Add feeds@feed2email.net to your contact list to make sure you receive all your emails

Make sure to visit feed2email.net to get more feeds sent to your inbox.

To find out which feeds you are subscribed to, or to get further help, just reply to this email.

StyleSeat, An Online Marketplace For Stylists & Beauty Pros, Raises $10.2M Series A From Lightspeed

Jan 22, 12:30PM

As hinted at last month, salon-booking service StyleSeat has now closed on its Series A round of funding. Led by Lightspeed Ventures, the company has raised an additional $10.2 million in outside investment, bringing its total raise to date to $14 million. The funding will be used to both grow the platform and the now 35-person StyleSeat team, which will double in 2014. Existing investor Lowercase Capital also participated in the round. StyleSeat has already seen a couple of notable new hires, with Andrew Dempsey, previously the Director of Business Intelligence at Netflix, now StyleSeat Senior Data Analyst, and Yulie Kim, former VP of Product at One Kings Lane, now StyleSeat VP of Product. According to StyleSeat co-founder and CEO Melody McCloskey, the company is also looking to staff up its data science and engineering teams, with a special emphasis on mobile, where they’ve hired five more engineers over the past month. First launched in 2011, StyleSeat has grown from some 55,000 salons and spas using its online booking platform as of mid-2012 to now over 200,000 beauty professionals. On average, these pros are able to grow their revenues 68 percent within their first 15 months of being on the platform, StyleSeat claims. That growth is due not only to the increase that comes from making themselves available for online bookings, but also from the reach of the other marketing tools StyleSeat provides. The freemium-based service charges for access to pro tools involving email marketing, advanced scheduling, reminders and more. The company has also been testing monetization efforts through on-site offers (ads), where it would take a 30 percent cut of the bookings. Both areas of the business are doing well, but the company doesn’t talk specifics when it comes to conversions or revenue. Consumers using the service today are able to search and browse StyleSeat to find stylists and other beauty professionals (e.g. waxing, nails, spa services, etc.), where they can check out their pro’s profile, view photos of their work, and then book an appointment when ready. Meanwhile, stylists are able to use the platform to manage appointments, client lists, their own profiles and photos, and now, thanks to the launch of the StyleSeat mobile app in December, they can even text or call their clients while on the go. Since the debut of the iOS and Android mobile client, created in response to a rapidly growing mobile visitor base on the

As hinted at last month, salon-booking service StyleSeat has now closed on its Series A round of funding. Led by Lightspeed Ventures, the company has raised an additional $10.2 million in outside investment, bringing its total raise to date to $14 million. The funding will be used to both grow the platform and the now 35-person StyleSeat team, which will double in 2014. Existing investor Lowercase Capital also participated in the round. StyleSeat has already seen a couple of notable new hires, with Andrew Dempsey, previously the Director of Business Intelligence at Netflix, now StyleSeat Senior Data Analyst, and Yulie Kim, former VP of Product at One Kings Lane, now StyleSeat VP of Product. According to StyleSeat co-founder and CEO Melody McCloskey, the company is also looking to staff up its data science and engineering teams, with a special emphasis on mobile, where they’ve hired five more engineers over the past month. First launched in 2011, StyleSeat has grown from some 55,000 salons and spas using its online booking platform as of mid-2012 to now over 200,000 beauty professionals. On average, these pros are able to grow their revenues 68 percent within their first 15 months of being on the platform, StyleSeat claims. That growth is due not only to the increase that comes from making themselves available for online bookings, but also from the reach of the other marketing tools StyleSeat provides. The freemium-based service charges for access to pro tools involving email marketing, advanced scheduling, reminders and more. The company has also been testing monetization efforts through on-site offers (ads), where it would take a 30 percent cut of the bookings. Both areas of the business are doing well, but the company doesn’t talk specifics when it comes to conversions or revenue. Consumers using the service today are able to search and browse StyleSeat to find stylists and other beauty professionals (e.g. waxing, nails, spa services, etc.), where they can check out their pro’s profile, view photos of their work, and then book an appointment when ready. Meanwhile, stylists are able to use the platform to manage appointments, client lists, their own profiles and photos, and now, thanks to the launch of the StyleSeat mobile app in December, they can even text or call their clients while on the go. Since the debut of the iOS and Android mobile client, created in response to a rapidly growing mobile visitor base on theIntercom Raises Another $23M For Its New, More Social Approach To CRM

Jan 22, 12:30PM

Intercom, a platform for companies to provide personalised customer responses online, is today announcing that it has raised another $23 million — funding that it will use to continue to develop its product and expand its marketing to compete against bigger players like Oracle, SAP and Salesforce (the behemoth that even uses ‘CRM’ as its stock ticker on the NYSE). The Series B round was led by Bessemer Venture Partners, and includes participation from previous investors Social+Capital Partnership. The company, which was originally incubated at 500 Startups, also counts the likes of Biz Stone and Huddle co-founder Andy McLoughlin as investors. This round brings the total raised by Intercom to $30 million. Intercom is among a new wave of companies that are generally called “social CRM” providers. The idea here is that everyone in your organisation should be able to communicate his/her knowledge to customers when and if it is needed. The theory is that this means not only better engagement from your employees in the bigger team effort, but also more satisfying responses for users. The evolution of CRM comes at a time of growth but also maturation of the internet: consumers expect better and more personalised responses. It’s a space ripe for change, says Intercom’s co-founder and CEO Eoghan McCabe (who hails, along with the other three co-founders, from Dublin), but it also speaks to a wider trend we’re experiencing, where innovation is happening not at the core of prodcuts, but around how they are delivered. (You could argue that the same is happening in areas like mobile technology, too, where we are seeing more incremental rather than massive shifts at the moment.) “CRM companies haven’t innovated in over ten years. Many of them are just ticketing systems. But what’s happening is that customer service is at the leading edge of great competitive online businesses,” he tells me. “In past, leadership was based on top engineering and good design. But today, the real leaders are those like Zappos people spend more there because they know they get to deal with a human.” Since coming out of beta 18 months ago, Intercom has picked up 2,000 paying businesses, among them Heroku, Hootsuite, Yahoo!, Perfect Audience, Rackspace, and Visual.ly.

Intercom, a platform for companies to provide personalised customer responses online, is today announcing that it has raised another $23 million — funding that it will use to continue to develop its product and expand its marketing to compete against bigger players like Oracle, SAP and Salesforce (the behemoth that even uses ‘CRM’ as its stock ticker on the NYSE). The Series B round was led by Bessemer Venture Partners, and includes participation from previous investors Social+Capital Partnership. The company, which was originally incubated at 500 Startups, also counts the likes of Biz Stone and Huddle co-founder Andy McLoughlin as investors. This round brings the total raised by Intercom to $30 million. Intercom is among a new wave of companies that are generally called “social CRM” providers. The idea here is that everyone in your organisation should be able to communicate his/her knowledge to customers when and if it is needed. The theory is that this means not only better engagement from your employees in the bigger team effort, but also more satisfying responses for users. The evolution of CRM comes at a time of growth but also maturation of the internet: consumers expect better and more personalised responses. It’s a space ripe for change, says Intercom’s co-founder and CEO Eoghan McCabe (who hails, along with the other three co-founders, from Dublin), but it also speaks to a wider trend we’re experiencing, where innovation is happening not at the core of prodcuts, but around how they are delivered. (You could argue that the same is happening in areas like mobile technology, too, where we are seeing more incremental rather than massive shifts at the moment.) “CRM companies haven’t innovated in over ten years. Many of them are just ticketing systems. But what’s happening is that customer service is at the leading edge of great competitive online businesses,” he tells me. “In past, leadership was based on top engineering and good design. But today, the real leaders are those like Zappos people spend more there because they know they get to deal with a human.” Since coming out of beta 18 months ago, Intercom has picked up 2,000 paying businesses, among them Heroku, Hootsuite, Yahoo!, Perfect Audience, Rackspace, and Visual.ly.Native Ad Company Sharethrough Raises $17M More

Jan 22, 12:30PM

Sharethrough, a startup focused on native advertising, is announcing that it has raised $17 million in its third round of funding. That breaks down to $7 million in equity and $10 million in debt. New investors in the round include Elevation Partners, Silver Creek, and Patrick Keane (a former Googler who's also Sharethrough's president), while existing investors North Bridge Venture Partners and Floodgate also participated.

Sharethrough, a startup focused on native advertising, is announcing that it has raised $17 million in its third round of funding. That breaks down to $7 million in equity and $10 million in debt. New investors in the round include Elevation Partners, Silver Creek, and Patrick Keane (a former Googler who's also Sharethrough's president), while existing investors North Bridge Venture Partners and Floodgate also participated.Tuniu.com The Latest IPO To Rise In The East

Jan 22, 6:09AM

The initial public offering for Chinese online tour booking web site Tuniu may not carry the heft of the impending Alibaba IPO juggernaut (rumored at $130 billion and counting), but it is a sign of investors’ continuing demand for public offerings from Chinese tech companies. The Beijing-based tour site has selected Credit Suisse and Morgan Stanley to run the offering process for its expected $100 million IPO, according to several sources with knowledge of the company’s plans. In the clearest public sign of the company’s intentions, one of its investors, Gobi Partners, announced that Conor Yang, the architect behind the public offering of both AirMedia Group and Dangdang.com, had been hired as Tuniu’s chief financial officer earlier this year. Tuniu has raised over $60 million in venture funding from investors including DCM, Gobi Partners, Sequoia Capital, Highland Capital Partners, and the Tokyo-based Internet services company, Rakuten Inc. Group tours are a huge business in China, where the government passed recent legislation regulating how guided tour companies operate, according to an October story on CNN. As the CNN story notes, 100 million Chinese will travel abroad by 2015 and as of 2012 the Chinese had already overtaken Americans and Germans as the biggest spenders on the international travel scene. A record $102 billion was spent by 83 million Chinese tourists on international tourism, CNN reported. Online travel in China has already netted venture investors big wins. Qunar.com, which went public in November 2013, was backed by Mayfield Fund, GSR Ventures Management, Tenaya Capital, GGV Capital, Hillhouse Capital, and the Chinese search technology behemoth Baidu, which shelled out $306 million for a massive stake in the company in 2011. That public offering netted the company $167 million, well above the $125 million target Qunar.com had set in its initial offering documents. Although Qunar.com ended Tuesday’s trading below its offering price, the company still has a market capitalization of over $3.05 billion. Investors in Chinese technology companies have also been buoyed by the performance of Chinese public offerings throughout the back half of 2013. Since 2012 and through to November of 2013 nine U.S. IPOs from China had produced an average return of 203%, including the 1,127% return for Vipshop. That online retail company, which is now trading at over $107 per-share – up from an initial offering price of $5.50 in March 2012 – has been a huge win for early investors like

The initial public offering for Chinese online tour booking web site Tuniu may not carry the heft of the impending Alibaba IPO juggernaut (rumored at $130 billion and counting), but it is a sign of investors’ continuing demand for public offerings from Chinese tech companies. The Beijing-based tour site has selected Credit Suisse and Morgan Stanley to run the offering process for its expected $100 million IPO, according to several sources with knowledge of the company’s plans. In the clearest public sign of the company’s intentions, one of its investors, Gobi Partners, announced that Conor Yang, the architect behind the public offering of both AirMedia Group and Dangdang.com, had been hired as Tuniu’s chief financial officer earlier this year. Tuniu has raised over $60 million in venture funding from investors including DCM, Gobi Partners, Sequoia Capital, Highland Capital Partners, and the Tokyo-based Internet services company, Rakuten Inc. Group tours are a huge business in China, where the government passed recent legislation regulating how guided tour companies operate, according to an October story on CNN. As the CNN story notes, 100 million Chinese will travel abroad by 2015 and as of 2012 the Chinese had already overtaken Americans and Germans as the biggest spenders on the international travel scene. A record $102 billion was spent by 83 million Chinese tourists on international tourism, CNN reported. Online travel in China has already netted venture investors big wins. Qunar.com, which went public in November 2013, was backed by Mayfield Fund, GSR Ventures Management, Tenaya Capital, GGV Capital, Hillhouse Capital, and the Chinese search technology behemoth Baidu, which shelled out $306 million for a massive stake in the company in 2011. That public offering netted the company $167 million, well above the $125 million target Qunar.com had set in its initial offering documents. Although Qunar.com ended Tuesday’s trading below its offering price, the company still has a market capitalization of over $3.05 billion. Investors in Chinese technology companies have also been buoyed by the performance of Chinese public offerings throughout the back half of 2013. Since 2012 and through to November of 2013 nine U.S. IPOs from China had produced an average return of 203%, including the 1,127% return for Vipshop. That online retail company, which is now trading at over $107 per-share – up from an initial offering price of $5.50 in March 2012 – has been a huge win for early investors likeDocker Raises $15M For Its Open-Source Platform That Helps Developers Build Apps In The Cloud

Jan 22, 5:00AM

The shift to scale out architectures and an app-centric culture has turned out well for Docker and its lightweight open-source “container” technology designed for developers to quickly move code to the cloud. That’s evident in today’s news that the company has raised $15 million in a Series B round led by Greylock Partners, with minority participation from Insight Venture Partners and existing investors Benchmark Capital and Trinity Ventures. Also participating is Yahoo! Co-Founder Jerry Yang, who has participated in previous rounds. Docker will use the funding to push toward the general availability of the Docker environment, develop commercial services that pair with the open-source technology and build a team to support the growing community. The technology path is similar to the one VMware followed in its early days when IT managed their corporate-owned infrastructure. These were state-of-the-art data centers that had to be optimized to run enterprise software. For these IT managers, VMware became a critical part of the equation so multiple virtual machines could run on its hypervisor and server environment. VMware is lauded for the excellent job it did in managing its technology so the end-user was not impacted and the IT manager could manage the infrastructure effectively. The similarity to VMware in its early days and the excitement that Docker has generated made it an attractive investment, said Jerry Chen, a general partner at Greylock who joined the venture capital firm in August. It is Chen’s first investment since joining Greylock. “One of the things we learned at VMware is be as frictionless as possible,” Chen said in a phone interview today. “Docker has that ability as well.” Docker also can be scaled from scratch. It can grow to multiple apps or be used on public or private servers, Chen said. And it can be scaled out in seconds, moved anywhere and all done without having to re-configure all over again. “Docker is the right tech to fit the rapid updates,” Chen said. Docker faces the challenge of making its technology easy-to-use with features that make it effective for a developer or a DevOps professional. For this new DevOps pro, Docker has to consider the management and orchestration of apps that are continuously updated using the Docker environment. For example, Docker will develop both public and private registries for developers to store their containers. It also plans to build management and orchestration tools that are needed as people and their organizations manage

The shift to scale out architectures and an app-centric culture has turned out well for Docker and its lightweight open-source “container” technology designed for developers to quickly move code to the cloud. That’s evident in today’s news that the company has raised $15 million in a Series B round led by Greylock Partners, with minority participation from Insight Venture Partners and existing investors Benchmark Capital and Trinity Ventures. Also participating is Yahoo! Co-Founder Jerry Yang, who has participated in previous rounds. Docker will use the funding to push toward the general availability of the Docker environment, develop commercial services that pair with the open-source technology and build a team to support the growing community. The technology path is similar to the one VMware followed in its early days when IT managed their corporate-owned infrastructure. These were state-of-the-art data centers that had to be optimized to run enterprise software. For these IT managers, VMware became a critical part of the equation so multiple virtual machines could run on its hypervisor and server environment. VMware is lauded for the excellent job it did in managing its technology so the end-user was not impacted and the IT manager could manage the infrastructure effectively. The similarity to VMware in its early days and the excitement that Docker has generated made it an attractive investment, said Jerry Chen, a general partner at Greylock who joined the venture capital firm in August. It is Chen’s first investment since joining Greylock. “One of the things we learned at VMware is be as frictionless as possible,” Chen said in a phone interview today. “Docker has that ability as well.” Docker also can be scaled from scratch. It can grow to multiple apps or be used on public or private servers, Chen said. And it can be scaled out in seconds, moved anywhere and all done without having to re-configure all over again. “Docker is the right tech to fit the rapid updates,” Chen said. Docker faces the challenge of making its technology easy-to-use with features that make it effective for a developer or a DevOps professional. For this new DevOps pro, Docker has to consider the management and orchestration of apps that are continuously updated using the Docker environment. For example, Docker will develop both public and private registries for developers to store their containers. It also plans to build management and orchestration tools that are needed as people and their organizations manageSnapchat Makes You "Find The Ghosts" To Keep Hackers From Stealing Your Phone Number

Jan 22, 2:56AM

Snapchat now verifies new users aren't robots by making them choose its ghost mascot in images. It's an attempt to keep out hackers who could steal phone numbers by exploiting a leaked database of details on 4.6 million accounts. A 16-year-old hacker proved he could do just that by finding the number of Snapchat CTO Bobby Murphy, but now he says Snapchat has patched the holes he harnessed.

Snapchat now verifies new users aren't robots by making them choose its ghost mascot in images. It's an attempt to keep out hackers who could steal phone numbers by exploiting a leaked database of details on 4.6 million accounts. A 16-year-old hacker proved he could do just that by finding the number of Snapchat CTO Bobby Murphy, but now he says Snapchat has patched the holes he harnessed.See Twitter's Founders As Nesting Dolls By The Creator Of Fail Whale

Jan 22, 2:35AM

Remember Fail Whale? It might be hard to recall now that Twitter is a public company with a $34.7 billion market cap, but a few years ago, the site had frequent outages as it struggled to scale up. The appearance of a placid-looking white whale borne aloft by eight birds was source of irritation and amusement for Twitter's users, and the image by artist Yiying Lu quickly became iconic.

Remember Fail Whale? It might be hard to recall now that Twitter is a public company with a $34.7 billion market cap, but a few years ago, the site had frequent outages as it struggled to scale up. The appearance of a placid-looking white whale borne aloft by eight birds was source of irritation and amusement for Twitter's users, and the image by artist Yiying Lu quickly became iconic.IBM's Shares Slip After Its Q4 Revenue Falls On Weak Hardware Performance

Jan 22, 2:21AM

This fine Tuesday, IBM reported its fourth-quarter financial performance and was greeted with raspberries from investors with period revenue of $27.7 billion and earnings per share excluding items of $6.13. Using GAAP, IBM earned $6.2 billion, or $5.73. Off nearly a percent in regular trading, IBM eased another 2.5 percent in after-hours trading. Investors had expected IBM to earn revenue of $28.25 billion and non-GAAP earnings per share of $5.99. So IBM beat on profit, but faltered on the top line question. As ZDNet points out, “IBM missed its revenue targets every quarter in 2013.” Zing. Right, so what’s going on? Well, the company’s hardware business had a terrifically terrible fourth quarter. As MarketWatch notes, “IBM’s systems and technology segment, also known as hardware, saw sales fall 26%, as pre-tax earnings fell by $768 million to $200 million.” Yes the hardware market is rough for incumbent players, but IBM’s decline in the category rivals the beleaguered PC OEM market. Revenue from hardware totaled $4.3 billion. IBM’s services group’s revenue fell 3.6 percent to $9.9 billion. The company did have a ray of sunshine to report, with software revenues up 2.8 percent to $8.1 billion, performance that CNBC called a “bright spot.” It’s worth noting that IBM had fourth-quarter revenue of $29.3 billion in 2012, so the company contracted on a year-over-year basis despite an improving economy. The downward swing in IBM’s share price was perhaps somewhat sedate compared to what we see in younger technology firms, but following a number of preceding misses, there was little optimism premium built into its valuation. Still, another disappointment from Big Blue. Short-term profitability can keep your stock afloat, but it is out of revenue growth that future net income is born. Top Image Credit: Flickr

This fine Tuesday, IBM reported its fourth-quarter financial performance and was greeted with raspberries from investors with period revenue of $27.7 billion and earnings per share excluding items of $6.13. Using GAAP, IBM earned $6.2 billion, or $5.73. Off nearly a percent in regular trading, IBM eased another 2.5 percent in after-hours trading. Investors had expected IBM to earn revenue of $28.25 billion and non-GAAP earnings per share of $5.99. So IBM beat on profit, but faltered on the top line question. As ZDNet points out, “IBM missed its revenue targets every quarter in 2013.” Zing. Right, so what’s going on? Well, the company’s hardware business had a terrifically terrible fourth quarter. As MarketWatch notes, “IBM’s systems and technology segment, also known as hardware, saw sales fall 26%, as pre-tax earnings fell by $768 million to $200 million.” Yes the hardware market is rough for incumbent players, but IBM’s decline in the category rivals the beleaguered PC OEM market. Revenue from hardware totaled $4.3 billion. IBM’s services group’s revenue fell 3.6 percent to $9.9 billion. The company did have a ray of sunshine to report, with software revenues up 2.8 percent to $8.1 billion, performance that CNBC called a “bright spot.” It’s worth noting that IBM had fourth-quarter revenue of $29.3 billion in 2012, so the company contracted on a year-over-year basis despite an improving economy. The downward swing in IBM’s share price was perhaps somewhat sedate compared to what we see in younger technology firms, but following a number of preceding misses, there was little optimism premium built into its valuation. Still, another disappointment from Big Blue. Short-term profitability can keep your stock afloat, but it is out of revenue growth that future net income is born. Top Image Credit: FlickrSF Approves Tech Bus Pilot Program Despite Public Dissent

Jan 22, 1:03AM

Today the San Francisco Municipal Transportation Agency approved a controversial pilot program that will see some 200 area bus stops made available to private shuttles that ferry corporate tech workers to campuses outside of the city. Despite impassioned, and occasionally coherent, commentary — not to mention more than a handful of Google talking points — the agency’s final deliberation was quick and to the point: Yes. The shuttles, often referred to as ‘Google Buses,’ have become frontline in an increasingly bitter argument between the younger, newer and wealthier technology workers that call San Francisco home, and long-time residents concerned about the balkanization of the city’s less well off. Toss in a still weak job market for most sectors, spiraling rent costs, and tax incentives to wealthy tech firms to stay local, and the miasma begins to boil. Shuttling employees south instead of forcing them to commute has ecological benefits: Fewer cars means less congestion and a lowered carbon footprint. But for private companies to use public spaces in flagrant violation of the law has many up in arms. The meeting room was packed. Also, the proposed one-dollar-per-stop fee that Google et al will pay is viewed by many as little more than a perfunctory donation, given that the folk of the city pay more for a bus ride inside the confines of their own area code. Frankly, tech companies have played their hands poorly: Instead of apologizing, offering to pay a fee for past transgressions, and a more reasonable tax per stop, they have offered little and placated no one. Still, they got their pilot program, so they won. The cleaving of San Francisco into two camps — those who think that Google is a public benefactor, and those that view it as a public menace — is not healthy for our little community. But then again as an Uber taking, young tech-related bastard, I’m probably biased. Whatever the case, the shuttles will continue to run. The pilot will proceed, and following something more permanent will take its place. That’s where we are now. Top Image Credit: Flickr

Today the San Francisco Municipal Transportation Agency approved a controversial pilot program that will see some 200 area bus stops made available to private shuttles that ferry corporate tech workers to campuses outside of the city. Despite impassioned, and occasionally coherent, commentary — not to mention more than a handful of Google talking points — the agency’s final deliberation was quick and to the point: Yes. The shuttles, often referred to as ‘Google Buses,’ have become frontline in an increasingly bitter argument between the younger, newer and wealthier technology workers that call San Francisco home, and long-time residents concerned about the balkanization of the city’s less well off. Toss in a still weak job market for most sectors, spiraling rent costs, and tax incentives to wealthy tech firms to stay local, and the miasma begins to boil. Shuttling employees south instead of forcing them to commute has ecological benefits: Fewer cars means less congestion and a lowered carbon footprint. But for private companies to use public spaces in flagrant violation of the law has many up in arms. The meeting room was packed. Also, the proposed one-dollar-per-stop fee that Google et al will pay is viewed by many as little more than a perfunctory donation, given that the folk of the city pay more for a bus ride inside the confines of their own area code. Frankly, tech companies have played their hands poorly: Instead of apologizing, offering to pay a fee for past transgressions, and a more reasonable tax per stop, they have offered little and placated no one. Still, they got their pilot program, so they won. The cleaving of San Francisco into two camps — those who think that Google is a public benefactor, and those that view it as a public menace — is not healthy for our little community. But then again as an Uber taking, young tech-related bastard, I’m probably biased. Whatever the case, the shuttles will continue to run. The pilot will proceed, and following something more permanent will take its place. That’s where we are now. Top Image Credit: FlickrForbes: "Should Microsoft Acquire Yahoo For $53 Billion?"

Jan 22, 12:30AM

No.

Apple Sends Out iPhone Survey, Seeks Feedback On Android, Touch ID And More

Jan 21, 11:10PM

Apple has begun to send out a survey asking shoppers who have recently purchased an iPhone to provide some feedback about their purchase and their experience with the device. TechCrunch ran through the survey, providing sample answers to determine the outcome, and found that there were a few areas in particular Apple wanted to hear more about from its customers.

Apple has begun to send out a survey asking shoppers who have recently purchased an iPhone to provide some feedback about their purchase and their experience with the device. TechCrunch ran through the survey, providing sample answers to determine the outcome, and found that there were a few areas in particular Apple wanted to hear more about from its customers.HiddenRadio Hits The Crowdfunding Path To Make Beautiful Music

Jan 21, 11:07PM

HiddenRadio was one of the first crowdfunding successes. The original model nearly hit $1 million on Kickstarter in 2012 and spawned legions of fans. The creators, John Van Den Nieuwenhuizen and Vitor Santa Maria, built a small Bluetooth speaker that offered excellent frequency response and acceptable bass with a very cool design aesthetic. Now they're back for more.

HiddenRadio was one of the first crowdfunding successes. The original model nearly hit $1 million on Kickstarter in 2012 and spawned legions of fans. The creators, John Van Den Nieuwenhuizen and Vitor Santa Maria, built a small Bluetooth speaker that offered excellent frequency response and acceptable bass with a very cool design aesthetic. Now they're back for more.Send In Your Questions For Ask A VC With Comcast Ventures' Dave Zilberman

Jan 21, 11:00PM

This week on TechCrunch TV's Ask A VC show, Comcast Ventures' Dave Zilberman is joining us in the studio to talk about enterprise IT investing and more. As you may remember, you can submit questions for our guests either in the comments or here and we'll ask them during the show.

This week on TechCrunch TV's Ask A VC show, Comcast Ventures' Dave Zilberman is joining us in the studio to talk about enterprise IT investing and more. As you may remember, you can submit questions for our guests either in the comments or here and we'll ask them during the show.Why Warren Buffett's Billion-Dollar Prize To Predict The Perfect NCAA Bracket Matters

Jan 21, 10:12PM

By this time next year, the world could see one more geeky billionaire. Investment mogul Warren Buffett’s Berkshire Hathaway company is backing a billion-dollar prize to predict the perfect NCAA tournament bracket. “We’ve seen a lot of contests offering a million dollars for putting together a good bracket, which got us thinking, what is the perfect bracket worth? We decided a billion dollars seems right for such an impressive feat,” said Jay Farner, President and Chief Marketing Officer of Quicken Loans, whose company is partnering with Berkshire Hathaway to fund the monstrous endeavor. The prize is interesting not because world peace has been held back by sub-optimal prediction algorithms, but by the testing of a very important scientific hypothesis: We can pay for innovation. If the billion dollars induces a winner, it will suggest that the big innovations can be overcome with enough people thinking about the problem. Prize-based competitions have become a major strategy for startups and governments alike, since the X Prize foundation successfully kicked off a new cottage industry of commercial space flight with a $10,000,000 bounty. The 2004 Ansari space X Prize (re)popularized a national innovation strategy over a century old. Since then, it has become more commonplace among the nation’s tech companies. In 2009, Netflix awarded $1 million to a programmer, who improved their recommendation engine (though it never ended up implementing it). Fueled by the momentum of the strategy, the White House is now a fan of promoting innovation through Challenge.gov, a clearinghouse for prize-based competitions. Prizes often seed a total amount of investment more than the award. Each team, regardless of whether they win, has to fund a certain amount of hours. Moreover, the teams often spend more than the prize amount, because they’re in the competition to win or because it could kickstart a lucrative business. The competition is seen as an investment. Prizes are a tricky business and don’t always work. Potentially, a massive purse could just bulldoze out all of the difficulties in conducting a successful competition. Anyone over the age of 21 is eligible to be among the 10 million registered participants. Winners will receive $25 million a year, or enough to buy a house in San Francisco. The odds are not in people’s favor, however. The odds of predicting 63 perfect games is 1 in 9.2 quintillion (that’s 18 zeros). For math fans, here’s a university professor explaining the

By this time next year, the world could see one more geeky billionaire. Investment mogul Warren Buffett’s Berkshire Hathaway company is backing a billion-dollar prize to predict the perfect NCAA tournament bracket. “We’ve seen a lot of contests offering a million dollars for putting together a good bracket, which got us thinking, what is the perfect bracket worth? We decided a billion dollars seems right for such an impressive feat,” said Jay Farner, President and Chief Marketing Officer of Quicken Loans, whose company is partnering with Berkshire Hathaway to fund the monstrous endeavor. The prize is interesting not because world peace has been held back by sub-optimal prediction algorithms, but by the testing of a very important scientific hypothesis: We can pay for innovation. If the billion dollars induces a winner, it will suggest that the big innovations can be overcome with enough people thinking about the problem. Prize-based competitions have become a major strategy for startups and governments alike, since the X Prize foundation successfully kicked off a new cottage industry of commercial space flight with a $10,000,000 bounty. The 2004 Ansari space X Prize (re)popularized a national innovation strategy over a century old. Since then, it has become more commonplace among the nation’s tech companies. In 2009, Netflix awarded $1 million to a programmer, who improved their recommendation engine (though it never ended up implementing it). Fueled by the momentum of the strategy, the White House is now a fan of promoting innovation through Challenge.gov, a clearinghouse for prize-based competitions. Prizes often seed a total amount of investment more than the award. Each team, regardless of whether they win, has to fund a certain amount of hours. Moreover, the teams often spend more than the prize amount, because they’re in the competition to win or because it could kickstart a lucrative business. The competition is seen as an investment. Prizes are a tricky business and don’t always work. Potentially, a massive purse could just bulldoze out all of the difficulties in conducting a successful competition. Anyone over the age of 21 is eligible to be among the 10 million registered participants. Winners will receive $25 million a year, or enough to buy a house in San Francisco. The odds are not in people’s favor, however. The odds of predicting 63 perfect games is 1 in 9.2 quintillion (that’s 18 zeros). For math fans, here’s a university professor explaining theHands-On With The New Basis Sleep Tracker

Jan 21, 9:52PM

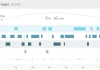

One of the most popular wrist health trackers, the Basis B1 smartwatch, has added sleep cycles to variables it automatically tracks. I got my hands on an early beta version (which is now publicly available) and have been comparing it for the last week to other popular sleep trackers on the market. The upshot: of all the consumer-grade sleep trackers, the Basis is easily the most sophisticated. It tracks light, deep, REM, and sleep interruptions, and conveniently displays the totals in a daily dashboard. Waking up feeling refreshed is one of the best things in life. Quality of sleep may be just as vital to peak cognitive performance as the duration. Relatively uninterrupted sleep with long bouts of rapid-eye movement (REM) may be important in boosting creativity, good memory, and weight loss. Basis claims its sleep tracking system is be more accurate than the competition, such as the Jawbone Up and Fitbit, because it can track resting heart-rate, which is known to correlate with various sleep states. “We aren’t making a claim we can replace sleep labs or can be as accurate,” Basis representative Damon Miller said. “But we feel we are in a good proximity for a consumer product.” So can your heart rate really tell Basis how well you’re sleeping? Yes and no. “Heart rate is not the same as brain waves. And brain waves tell us what stage of sleep we’re in,” said Dr. Lisa Meltzer, a sleep researcher at National Jewish Health hospital in Denver. That said, compared to the competition, Basis did give me a more nuanced view of my sleep cycle, which could be quite valuable. Last Monday, Jawbone says I got 4:15 of light sleep, compared to 3:08 with Basis. Combined REM and deep was 2:53, compared to 2:05 total deep with Jawbone. Basis claims I woke up two times, with Jawbone claiming I woke up once. There are a few important caveats. With the Basis, all of this is automatically recorded. With the Jawbone, I had to manually input my sleep times after the fact, which is just something I could remember to do on a regular basis. I also have to remember when I fell asleep. On the other hand, I was up for about 20 minutes early on Martin Luther King day, before drifting back to bed for another hour. Basis says this next bout was 100 percent light sleep, while

One of the most popular wrist health trackers, the Basis B1 smartwatch, has added sleep cycles to variables it automatically tracks. I got my hands on an early beta version (which is now publicly available) and have been comparing it for the last week to other popular sleep trackers on the market. The upshot: of all the consumer-grade sleep trackers, the Basis is easily the most sophisticated. It tracks light, deep, REM, and sleep interruptions, and conveniently displays the totals in a daily dashboard. Waking up feeling refreshed is one of the best things in life. Quality of sleep may be just as vital to peak cognitive performance as the duration. Relatively uninterrupted sleep with long bouts of rapid-eye movement (REM) may be important in boosting creativity, good memory, and weight loss. Basis claims its sleep tracking system is be more accurate than the competition, such as the Jawbone Up and Fitbit, because it can track resting heart-rate, which is known to correlate with various sleep states. “We aren’t making a claim we can replace sleep labs or can be as accurate,” Basis representative Damon Miller said. “But we feel we are in a good proximity for a consumer product.” So can your heart rate really tell Basis how well you’re sleeping? Yes and no. “Heart rate is not the same as brain waves. And brain waves tell us what stage of sleep we’re in,” said Dr. Lisa Meltzer, a sleep researcher at National Jewish Health hospital in Denver. That said, compared to the competition, Basis did give me a more nuanced view of my sleep cycle, which could be quite valuable. Last Monday, Jawbone says I got 4:15 of light sleep, compared to 3:08 with Basis. Combined REM and deep was 2:53, compared to 2:05 total deep with Jawbone. Basis claims I woke up two times, with Jawbone claiming I woke up once. There are a few important caveats. With the Basis, all of this is automatically recorded. With the Jawbone, I had to manually input my sleep times after the fact, which is just something I could remember to do on a regular basis. I also have to remember when I fell asleep. On the other hand, I was up for about 20 minutes early on Martin Luther King day, before drifting back to bed for another hour. Basis says this next bout was 100 percent light sleep, while"Pressure-Free" Car Buying Service CarWoo! Shuts Down

Jan 21, 9:37PM

Today is the day for shutdowns, it seems. Joining Outbox and Canvas/DrawQuest as the latest to dive into the Deadpool is CarWoo, a service that aimed to make buying a car less awful.

Today is the day for shutdowns, it seems. Joining Outbox and Canvas/DrawQuest as the latest to dive into the Deadpool is CarWoo, a service that aimed to make buying a car less awful.Think Software Keyboards Don't Work On Smartwatches? Check Out Minuum's New Video

Jan 21, 9:33PM

As smartwatches become a device category that most major hardware makers are turning their attention to, there’s a question of how much smartphone utility we’ll be able to translate to the wrist. One big convenience hurdle is making it possible to reply to texts and emails quickly from the wrist, and that’s where Minuum‘s go-anywhere software keyboard comes in. The Minuum keyboard from Toronto-based startup Whirlscape is an alternative input method originally prototyped on smartphones that makes it easier to type naturally without using much of the screen. It launched previously in beta on Android, and has done well on smartphones, according to user reviews. Whirlscape had always designed their keyboard to be usable on any number of connected devices, including wearables, the founders told me in the past. Today, they’ve got proof: As you can see in the video above, Minuum running on a Galaxy Gear smartwatch manages text input much more conveniently than you might imagine possible from a screen so small. It was filmed in a single take, too, according to the Minuum team, without any fancy camera tricks. For now, Minuum says this is just an “in-house demo,” at least until Samsung opens up the Gear platform, but the company also tells me that it’s already in talks with other smartwatch manufacturers who can put the software on shipping devices “in the upcoming months.”

As smartwatches become a device category that most major hardware makers are turning their attention to, there’s a question of how much smartphone utility we’ll be able to translate to the wrist. One big convenience hurdle is making it possible to reply to texts and emails quickly from the wrist, and that’s where Minuum‘s go-anywhere software keyboard comes in. The Minuum keyboard from Toronto-based startup Whirlscape is an alternative input method originally prototyped on smartphones that makes it easier to type naturally without using much of the screen. It launched previously in beta on Android, and has done well on smartphones, according to user reviews. Whirlscape had always designed their keyboard to be usable on any number of connected devices, including wearables, the founders told me in the past. Today, they’ve got proof: As you can see in the video above, Minuum running on a Galaxy Gear smartwatch manages text input much more conveniently than you might imagine possible from a screen so small. It was filmed in a single take, too, according to the Minuum team, without any fancy camera tricks. For now, Minuum says this is just an “in-house demo,” at least until Samsung opens up the Gear platform, but the company also tells me that it’s already in talks with other smartwatch manufacturers who can put the software on shipping devices “in the upcoming months.”Yahoo Acquires Mobile Marketing Startup Sparq

Jan 21, 9:09PM

Mobile marketing company Sparq announced on its site today that it has been acquired by Yahoo. The company did not disclose the purchase price. Yahoo declined to illustrate the deal’s financial details. Sparq’s team will be joining Yahoo’s Sunnyvale campus. Before it was acquired, Sparq raised a total of $1.7 million over several small rounds, most recently picking up more than $650,000 last year. According to a Yahoo spokesperson, the company’s technology helped users “jump from app to app to discover, consume and engage with content.” Or, put more simply, it helped users take in more total mobile content. The fit with Yahoo is quite plain: Yahoo needs to monetize its mobile user base if it wants its mobile-first strategy to drive lacking revenue growth. Picking up a firm that specializes in that space is reasonable. And, given how little the company raised, it was likely a cheap pick-up for Yahoo. Given Sparq’s focus on inter-app movement, Yahoo might be able to deploy its technology to help its users move between its own stable of applications. It isn’t clear if the company’s assets will be used in that fashion. However, if Yahoo could lash its apps together in a more cohesive fashion, it could bolster its engagement per user, and presumably its revenue per user. For a company that is forcing Wall Street to remain patient in the face of its slipping top line, such increases would be welcome indeed. Top Image Credit: Flickr

Mobile marketing company Sparq announced on its site today that it has been acquired by Yahoo. The company did not disclose the purchase price. Yahoo declined to illustrate the deal’s financial details. Sparq’s team will be joining Yahoo’s Sunnyvale campus. Before it was acquired, Sparq raised a total of $1.7 million over several small rounds, most recently picking up more than $650,000 last year. According to a Yahoo spokesperson, the company’s technology helped users “jump from app to app to discover, consume and engage with content.” Or, put more simply, it helped users take in more total mobile content. The fit with Yahoo is quite plain: Yahoo needs to monetize its mobile user base if it wants its mobile-first strategy to drive lacking revenue growth. Picking up a firm that specializes in that space is reasonable. And, given how little the company raised, it was likely a cheap pick-up for Yahoo. Given Sparq’s focus on inter-app movement, Yahoo might be able to deploy its technology to help its users move between its own stable of applications. It isn’t clear if the company’s assets will be used in that fashion. However, if Yahoo could lash its apps together in a more cohesive fashion, it could bolster its engagement per user, and presumably its revenue per user. For a company that is forcing Wall Street to remain patient in the face of its slipping top line, such increases would be welcome indeed. Top Image Credit: FlickrGame Maker Kabam Doubles Its Annual Revenues To $360M

Jan 21, 8:59PM

Kabam, the San Francisco-based social and mobile game maker that bought itself naming rights to UC Berkeley’s stadium, said it doubled its annual revenues to $360 million this year. That gives another revenue benchmark for top-grossing game makers. Kabam, which made a hard pivot from Facebook to mobile a few years ago, has two games in the top grossing 50 on the iPhone in the U.S. For comparison, other top mobile game makers like Supercell reported making $2.4 million per day early last year. About 70 percent of Kabam’s revenues come from iOS and Android, while the remainder is from Facebook and a destination site at Kabam.com. While the company is profitable, it’s not clear how profitable they are. They ended last year with $70 million on hand in cash, about $25 million up from the cash they had on hand at the end of 2012. But they also made some acquisitions too, like Exploding Barrel Games out of Vancouver, Canada. The company is touting these numbers at an interesting time in the gaming industry. (Maybe this is for recruiting? To attract buyers? To keep investors aware of the brand if they ever decide to go public?) Since Zynga went out to market in a late 2011 IPO and saw its valuation decline by more than half, no other big social gaming companies in Western markets have tested the waters with public investors. There have been rumors that European gaming company King is exploring an IPO, but we haven’t heard about additional progress on this front. Meanwhile, Supercell found a very lucky and unusual deal when it sold more than half the company to carrier Softbank and Japanese gaming company GungHo for roughly $1.5 billion last year. But most everyone else has decided to stay private. So there are several profitable, self-sustaining companies like Kabam and Kixeye waiting in the wings. To give its employees liquidity, Kabam held a secondary offering that let current and former employees, along with early investors, sell $38.5 million of their holdings. The company, which has raised more than $125 million in venture funding, was valued at $700 million in this last round.

Kabam, the San Francisco-based social and mobile game maker that bought itself naming rights to UC Berkeley’s stadium, said it doubled its annual revenues to $360 million this year. That gives another revenue benchmark for top-grossing game makers. Kabam, which made a hard pivot from Facebook to mobile a few years ago, has two games in the top grossing 50 on the iPhone in the U.S. For comparison, other top mobile game makers like Supercell reported making $2.4 million per day early last year. About 70 percent of Kabam’s revenues come from iOS and Android, while the remainder is from Facebook and a destination site at Kabam.com. While the company is profitable, it’s not clear how profitable they are. They ended last year with $70 million on hand in cash, about $25 million up from the cash they had on hand at the end of 2012. But they also made some acquisitions too, like Exploding Barrel Games out of Vancouver, Canada. The company is touting these numbers at an interesting time in the gaming industry. (Maybe this is for recruiting? To attract buyers? To keep investors aware of the brand if they ever decide to go public?) Since Zynga went out to market in a late 2011 IPO and saw its valuation decline by more than half, no other big social gaming companies in Western markets have tested the waters with public investors. There have been rumors that European gaming company King is exploring an IPO, but we haven’t heard about additional progress on this front. Meanwhile, Supercell found a very lucky and unusual deal when it sold more than half the company to carrier Softbank and Japanese gaming company GungHo for roughly $1.5 billion last year. But most everyone else has decided to stay private. So there are several profitable, self-sustaining companies like Kabam and Kixeye waiting in the wings. To give its employees liquidity, Kabam held a secondary offering that let current and former employees, along with early investors, sell $38.5 million of their holdings. The company, which has raised more than $125 million in venture funding, was valued at $700 million in this last round.Nexmo Locks Up $18M At $100M+ Valuation As It Forecasts 100% Revenue Growth In 2014

Jan 21, 8:58PM

Nexmo, a quickly growing telco API firm that provides SMS and voice services has locked down $18 million in fresh capital in a Series C round of funding that values the company at more than $100 million. The new capital was led by Sorenson Capital, with participation from previous investors, including Intel Capital on a pro rata basis.

Nexmo, a quickly growing telco API firm that provides SMS and voice services has locked down $18 million in fresh capital in a Series C round of funding that values the company at more than $100 million. The new capital was led by Sorenson Capital, with participation from previous investors, including Intel Capital on a pro rata basis.If at any time you'd like to stop receiving these messages, just send an email to feeds_feedburner_com_techcrunch+unsubscribe-hmdtechnology=gmail.com@mail.feed2email.net.

To stop all future emails from feed2email.net you can reply to this email with STOP in the subject line. Thanks